Shenzhen export tax rebates, day trips

First, to the factory definition

Transfer to the factory is a customs term, to the factory (export re-import): A Canadian trade enterprises will be bonded materials processing of processed products to another Canadian trade enterprises re-export processing business activities. That is to say only to the Canadian plant can be carried out in both trade enterprises.

However, in actual trade, there will be a lot of situations: 1, there are many semi-finished products suppliers to sell products to finished products manufacturers have difficulties. Finished products manufacturers are trade enterprises, and suppliers are general enterprises. 2, at the same time, two factories of Canadian trade enterprises, due to the different ownership of the customs, the manual record information differences and other issues, may lead to not be able to switch to the factory; the same time,

At this point, through the bonded area, you can achieve "to plant" operation, to achieve trade delivery; to solve more "to plant": to export tax rebates? -can!

1, the general enterprise sales of products to the Canadian trade enterprises to use "indirect factory", is the supplier of products to the bonded area, trade enterprises and then trade manuals from the bonded area of imports. This can completely solve the general manufacturing enterprises and Canadian trade enterprises to plant problems. At the same time, imports of Canadian trade enterprises are bonded, and suppliers can apply for export tax rebates to the Inland Revenue Department.

2, with the processing trade of the two factories, because not the same as the competent customs, manual records of goods information is different, through the bonded area operation, to achieve the purpose of plant delivery. The two sides of the factory were to take manual information to the bonded area customs declaration export or import, and load vehicles into the area without unloading, the same day to customs clearance of imports, to achieve "one-day tour" operation (actually only about 3 hours).

3, the Canadian trade factory supply to the general factory, that is, export to domestic sales, but also "to plant" mode: the Canadian trade factory goods to the bonded way to export bonded to the Bonded Zone (Shenzhen Export Processing Zone), general factory Zeyi general Trade the way the import tax domestic.

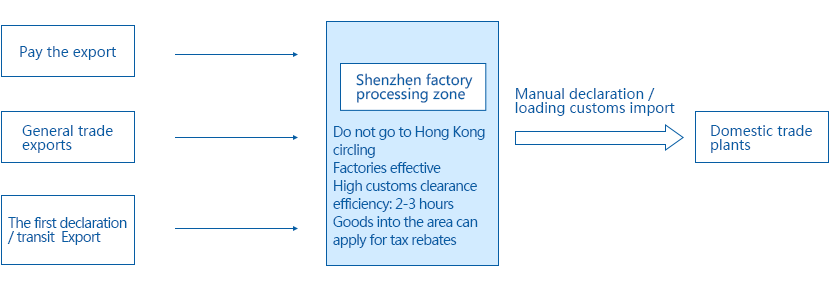

FLOW DIAGRAM:

Shenzhen Export Processing Zone is the most comprehensive bonded logistics export processing zone in Guangdong. In policy support, has also been given an export tax rebate, Shenzhen export tax rebate (goods into the area can apply for tax rebates) policy advantage.

In terms of simple tax rebate, the export of goods transport enterprises do not need to unload, and only need to Dongtai International Shenzhen customs declaration, customs clearance to complete the relevant procedures can apply for tax rebates, from the beginning into the whole process takes about 2-3 hours Can be completed. 2-3 hours, the goods can be transported by transport vehicles through the port to Hong Kong or to plant transport.